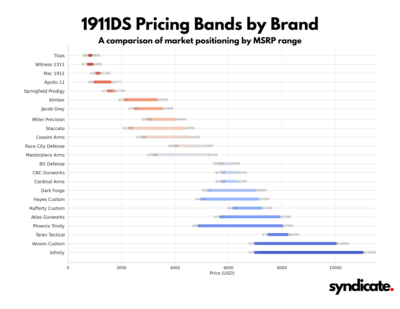

Mapping the 1911DS Market: Pricing Bands, Gaps, and Strategic Entry Points

The 1911DS (double-stack 1911) handgun market reveals a diverse and competitive landscape, segmented by pricing tiers that reflect brand positioning, performance tiers, and perceived value. A recent pricing band visualization compares MSRP ranges across 23 brands, from budget imports to ultra-premium custom shops. For new entrants, this data highlights both market opportunities and key challenges when determining how to position products.

Market Segmentation: A Tiered Price Landscape

The market naturally breaks down into three pricing tiers:

1. Entry-Level Segment (< $2,000)

Brands: Tisas, Witness 2311, Mac 1911, Apollo 11, Springfield Prodigy

-

Key traits: Mass-market appeal, lower manufacturing costs, and imported components.

-

Opportunity: Extremely price-sensitive. Hard to compete on cost without scale.

-

Challenge: High volume, razor-thin margins, and minimal brand differentiation.

2. Mid-Tier Segment ($2,000–$5,000)

Brands: Kimber, Jacob Grey, Staccato, Cosaint Arms, Miller Precision, Race City Defense

-

Key traits: Blends performance and brand cachet. Often carry law enforcement or tactical credibility.

-

Opportunity: This tier has the greatest number of brands, but there’s still white space in the $3,500–$4,000+ area, especially with unique designs or proven performance enhancements.

-

Challenge: Crowded field. New brands need a compelling performance story or unique aesthetic to stand out.

3. High-End / Custom Segment ($5,000–$11,000)

Brands: BG Defense, CNC Gunworks, Atlas Gunworks, Hayes Custom, Infinity, Venom Custom, Taran Tactical

-

Key traits: Boutique-level craftsmanship, customization, and prestige branding.

-

Opportunity: Strong brand loyalty at the high end. Notably, Infinity and Venom Custom stretch well beyond $10,000, but there’s room in the $6,000–$7,000 niche where fewer competitors operate.

-

Challenge: Entering this space requires extensive R&D, a master gunsmith reputation, and often competition pedigree (e.g., 3-Gun, USPSA).

Pricing Gaps to Exploit

From the visualization, there are notable pricing voids:

-

$1,700–$2,200 gap: A small but potentially lucrative zone between Springfield Prodigy and Kimber. Could support a “premium entry-level” gun with better materials or optics-ready configuration.

-

$3,500–$4,000 band: Underserved compared to the saturation below $3,500. Ideal for a brand looking to “bridge” mid-tier and semi-custom offerings.

-

$6,200–$7,000 zone: A premium tier with very few players. For a brand with a solid tactical reputation, this is a high-margin space to explore.

Strategic Challenges for New Brands

-

Brand trust is everything: Established players like Staccato and Taran Tactical command premiums due to performance history, endorsements, and agency adoption.

-

Price anchoring matters: Without recognition, starting above $2,500 may be risky unless backed by differentiators like proprietary recoil systems or elite competition lineage.

-

Gap exploitation ≠ success: Just because there’s a pricing gap doesn’t guarantee sales. Any new entrant must still prove value — especially in the shadow of established legends.

Conclusion: Room to Move, but Not Without Strategy

For a new 1911DS brand, the data shows there is room to innovate — particularly in emerging premium mid-tier and upper custom zones. However, pricing alone won’t drive success. A compelling story, performance validation, and community trust are key. Brands looking to enter should focus on what truly differentiates their gun — not just where it falls on the price chart.