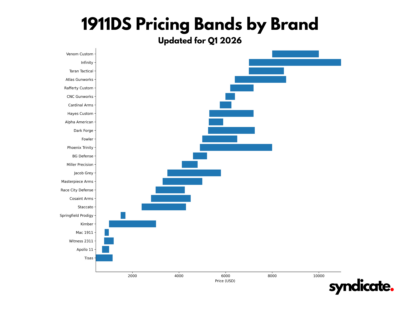

Mapping the 1911DS Market: Q1 2026 Update

AI Analysis of the price band movement in DS1911s in the last 12 months. This is using the data my team generated:

Here are the punch lines:

Entry pricing is stabilizing, not racing to the bottom

Mid-tier competition is intensifying, with overlapping price bands

Premium and ultra-premium brands are successfully lifting the ceiling

and the whole story…

1911DS Pricing Bands: Market Movement from Last Year to Q1 2026

Comparing last year’s 1911DS pricing landscape to Q1 2026 reveals a market that continues to stretch upward, while simultaneously compressing in the middle. The overall story is not one of uniform inflation, but of intentional repositioning by manufacturers as the category matures.

Entry Market: Stable, Slightly Consolidated

At the entry level, manufacturers such as Tisas, Apollo 11, Witness 2311, and Mac 1911 show minimal upward movement year over year. Price increases, where present, appear modest and largely attributable to input costs rather than repositioning. The key trend here is range tightening—fewer aggressive low-end SKUs and more focus on consistent MSRP bands, suggesting margin protection over volume expansion.

Mid-Tier Performance: The Most Competitive Segment

The mid-tier continues to be the most crowded and contested price band. Brands like Springfield Prodigy, Kimber, Staccato, Cosaint Arms, Race City Defense, and Masterpiece Arms have generally nudged upward at the top end, while holding or slightly raising entry pricing.

This creates visible overlap between manufacturers that previously occupied clearer lanes. The result is a compressed performance tier where differentiation is less about price and more about features, fit/finish, and brand credibility. This segment shows the strongest evidence of strategic pricing rather than reactive pricing.

Premium / Custom: Deliberate Upward Repositioning

Premium and semi-custom manufacturers—including Jacob Grey, Miller Precision, BG Defense, Phoenix Trinity, Fowler, Dark Forge, and Hayes Custom—demonstrate clear upward movement, particularly on flagship and extended-lead-time models.

Rather than expanding downward to capture volume, most of these brands appear to be defending premium positioning, raising ceilings faster than floors. This reinforces a narrative of craftsmanship, exclusivity, and reduced production capacity as a value signal rather than a limitation.

Ultra-Premium: The Ceiling Continues to Rise

At the top end, Atlas Gunworks, Taran Tactical, Venom Custom, and Infinity continue to push the upper boundary of the category. Compared to last year, the most notable movement is not entry price—but expanded top-end range.

Infinity and Venom Custom, in particular, stretch well beyond previous ceilings, signaling that the ultra-premium buyer remains active and relatively price-insensitive. Atlas Gunworks and Taran Tactical show more controlled expansion, reinforcing their roles as performance benchmarks rather than luxury outliers.

What This Means for the Category

From last year to Q1 2026, the 1911DS market shows three clear signals:

- Entry pricing is stabilizing, not racing to the bottom

- Mid-tier competition is intensifying, with overlapping price bands

- Premium and ultra-premium brands are successfully lifting the ceiling

In short, the market is no longer simply growing—it is sorting itself. Pricing has become a strategic tool for brand positioning, not just a response to cost, and manufacturers that clearly communicate why they sit where they do are best positioned moving forward.